Press release, 28 February 2020

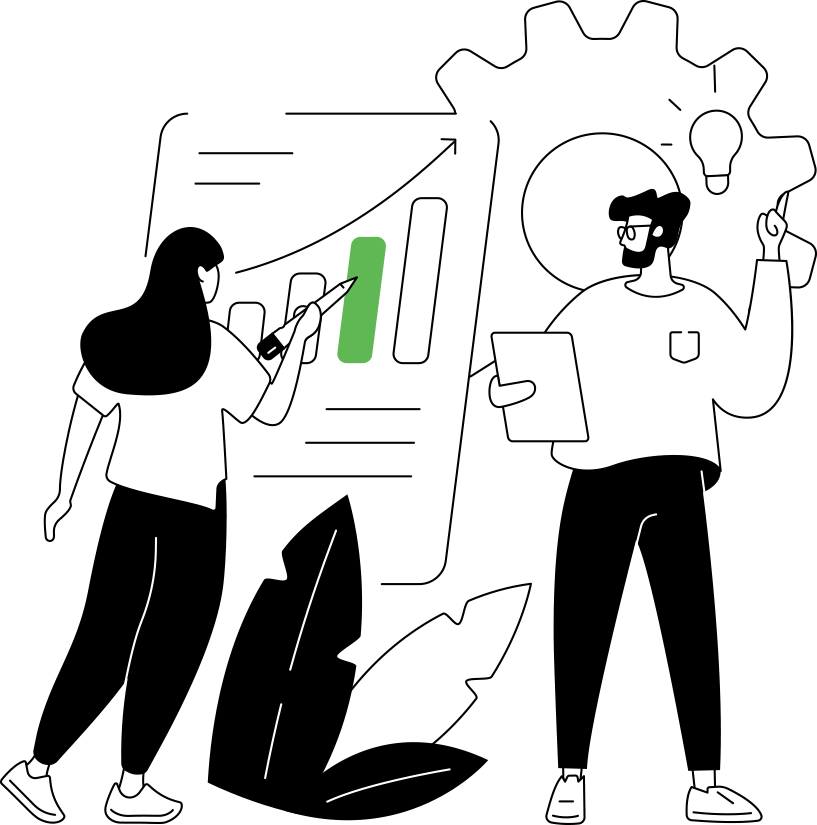

The KTI Index, reflecting the Finnish property investment market, delivered a total return of 8.8% in 2019, on the back of an income return of 4.7% and capital growth of 4.0%. The returns were supported by a significant increase in the market values for residential investment properties. Industrial properties delivered the second highest total return thanks to high income returns. Office properties saw modest, positive capital returns, while capital values of retail properties continued to decline. Emerging sectors such as public use properties and hotels have grown in importance in the property investment market.

Total returns by property sector in 2019

Source: KTI Index

The KTI Index reflects institutional property investments worth EUR 27.5 bn, representing some 36% of the Finnish institutional property investment market. The total return reflects the sum of income return and capital growth of standing investments worth EUR 23 bn held during the entire year.

Significant increase in market values of residential properties

Of the main property sectors, residential properties held on to the top position in 2019 with a total return of 14.3%. Increased market values supported capital growth of 9.7% while the income return declined to 4.2%. Residential properties are the largest of the institutional property investment sectors and consequently their weight in the overall index is large. Some large residential investors changed from a transaction-based valuation technique to a yield-based approach, which was a significant driver of the capital growth seen in 2019.

The total return calculations are based on property valuations, that are subject to changes in market structure and practices from time to time. More detailed drivers of total returns provide further insights to analysing investment performance.

Low interest rates and high investor demand in the last few years have resulted in a decline in the valuation yield on residential property investments to only 4.2%, that in turn was a clear driver of the positive capital growth for residential properties in 2019. In addition, increases in rental values had a positive effect on market values.

Income returns for offices fell further

Total returns for offices nudged lower from last year to 5.9% in 2019, reflecting a positive contribution from capital growth of approximately one per cent while income return fell to 4.6%. An increase in average occupancy rates to close to 88% was offset by higher maintenance spending to attract tenants and hence depressing income returns. The lower income returns also reflect an increased focus on higher-valued, lower-yielding office properties. The highest capital growth was again recorded in Helsinki CBD, where the income return fell to 3.6%.

Retail property values continued to head lower

Market values of retail properties have shown consecutive annual declines since 2011 on the back of the growth in online retailing and changes in consumer behaviour affecting demand and rental levels negatively. In 2019 market values for retail properties declined another 2.2%, reflecting lower values in the whole country for both shopping centres and other retail properties. Income returns also fell on the back of lower rents and occupancy rates in combination with higher operating costs.

Income returns for industrial properties, i.e. industrial, warehouse and logistics properties, declined slightly from the previous year but remained relatively high at around seven per cent. In combination with a slight increase in market values, Industrial properties reached a total return of close to eight per cent.

Growing investor interest in public use and hotel properties

The stable income returns of property investments have attracted large inflows of capital in recent years. Investor interest has spread from traditional property sectors into other parts of the market. As a result, the combined market value of public use properties has increased to over EUR 5 bn. The sector includes a mix of properties used for, for example, assisted housing, health care, education and culture. The total return for the sector reached 6.9%, reflecting an income return of 6.3% and a modest capital growth.

Hotel properties have continued to gain investor interest with new hotels actively being developed in several larger cities. Particularly in Helsinki, many older office properties are being converted to hotels. Total returns for hotels remained strong in 2019 at around seven per cent on the back of market values continuing heading higher and an income return above five per cent.

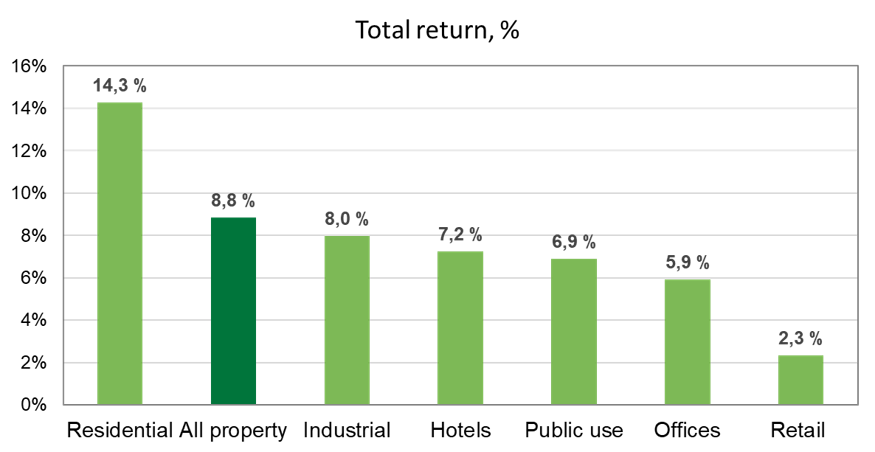

Total returns by property sector 2000–2019

Source: KTI Index

For further information, please contact:

Markus Steinby, tel. +358 50 464 7587

Hanna Kaleva, tel. +358 40 555 5269

KTI Finland is an independent research organisation and service company providing information and research services for the Finnish real estate industry. KTI Finland has calculated the KTI Index since 1998 and it reflects the total return of annual income and capital returns on property investments. In 2019, 28 property investors contributed to the KTI Index and the database covers some €27.5 billion worth of properties.

The contributors to the KTI Index include: Aberdeen Standard Investments, Ahlström Capital, Akiva Kiinteistöt I Ky, Erikoissijoitusrahasto Aktia Toimitilakiinteistöt, Alma Property Partners, Areim Fastigheter, Avain Vuokrakodit, Avara, Brunswick Real Estate, CBRE Global Investors, Citycon, Elo, Erikoissijoitusrahasto eQ Hoivakiinteistöt, Exilion Management, Genesta, Hemsö, Ilmarinen, Julius Tallberg Real Estate Corporation, Keva, Kojamo, LocalTapiola, Mercada, OP Real Estate Asset Management, Sampo, Turku Technology Properties, Varma, Veritas and Ylva.