Press release, 9 March 2021

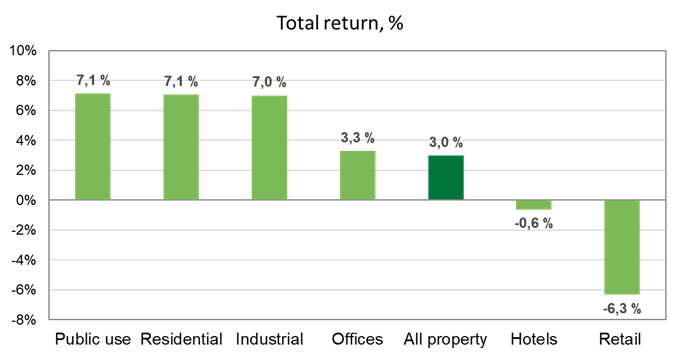

According to the KTI Property Index, the total return in the Finnish property investment market decreased to 3.0% in 2020. The total return was weighed down by a 1.2% decline in market values. Net income also decreased from the previous year and stood at 4.3%. The year was characterized by increasing differences between the performance of different property sectors and regions. Residential properties continued to produce healthy returns, and their role in the investment market continues to strengthen. Retail properties suffered the most from the COVID-19 pandemic.

KTI Property Index results are based on the portfolios of 29 professional property investors, with a total property portfolio value of approximately €32 billion. The Index covers 39% of the total property investment universe. The Index reflects the total return on properties held throughout the whole year and comprises of annual net income and capital growth.

Total return by property sector in 2020

Source: KTI Index

The exceptional year increased differences between property sectors

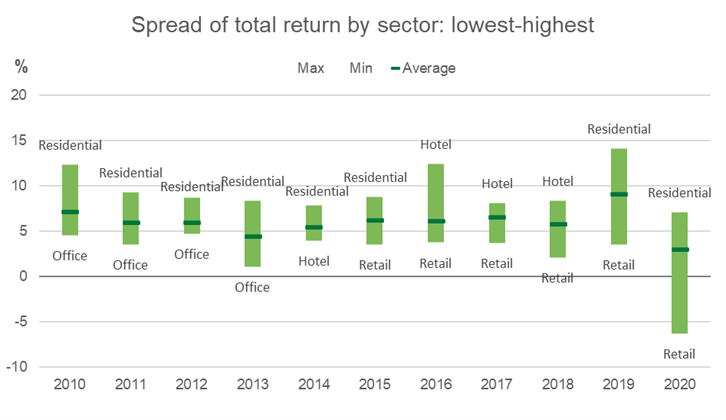

The COVID-19 pandemic and its impact on various property sectors was clearly reflected in investment returns in 2020. Differences in total returns between property sectors were larger than ever before in the Index’s history, which dates back to 1999. Residential and public use properties outperformed all other property sectors, with a total return that was 13.4 percentage points higher than that of retail properties.

Spread of total return by property sector 2010-2020

Source: KTI Index

Positive capital growth supports residential property returns

Total return on residential properties decreased from its peak level in 2019, but remained at a healthy level of 7.1%. Also in 10 and 20 year periods, residential properties outperform all other property sectors with their average annual returns exceeding 8%. Positive capital growth is the main driver for residential returns: market values of residential properties have increased every year since the start of the KTI Index. Net income continued to decrease in 2020 and fell below 4%. Net income was pressured by both increasing capital values and slightly decreasing occupancy rate.

Office property returns vary between regions

Office properties retain their position as the largest commercial property sector. In 2020, office properties produced a total return of 3.3%, while market values decreased by just over one per cent. In the Helsinki

central business district, market values remained stable, whereas in all other areas, market values declined. Net income decreased also for office properties in 2020. Occupancy rates declined after a couple of years’ positive development and stood at approximately 85%.

Total return on retail properties lowest ever in the KTI Index history

Total return on retail properties collapsed to -6.3%, which is the lowest sector-level annual total return ever in the KTI Index history. Approximately 75% of all retail properties in the KTI dataset are shopping centres, which were hit severely by the COVID-19 pandemic. Uncertain outlook for retail markets increase yields and decrease rental values, and market values decreased significantly in the Helsinki metropolitan area shopping centres in particular. Income return on retail properties was pressured by both decreasing rents and occupancy rates.

Logistics properties performed best among industrial property sector

The industrial property sector covers various kinds of manufacturing, warehouse and logistics properties. The sector’s average total return remained healthy at 7%, supported by a strong net income. Within the sector, the best returns of almost 8% were generated by logistics properties in the Helsinki metropolitan area. Market values of manufacturing and warehouse properties declined slightly, but, due to the high net income, total returns amounted to 6-7%.

Public use properties produced a total return of over 7%

Public use properties have increased their attractiveness in the investment market in recent years, and, according to the KTI estimates, the total value of public use properties in the investment market amounted to approximately €6 billion at the end of 2020. The sector includes, for instance, educational, health care and assisted living properties. In 2020, the sector’s average total return amounted to 7.1%. Net income varied between 4.5 and 5.5% for different kinds of public use properties.

For further information, please contact:

Hanna Kaleva, managing director, KTI Property Information lrd, +358 40 5555 269

KTI is an independent market information and research service company servicing the professional property investment sector in Finland.

Contributors for the KTI Index in 2020: Aberdeen Standard Investments, Akiva Kiinteistöt I Ky, Erikoissijoitusrahasto Aktia Toimitilakiinteistöt, Antilooppi, CBRE Global Investors, Alma Property Partners, Areim Fastigheter, Avara, Avain Vuokrakodit, Citycon, Elo, eQ, Exilion Management, Evli, Genesta, Ilmarinen, Julius Tallberg-Kiinteistöt, Keva, Kojamo, LocalTapiola, Mercada, OP Property Investment, Premico, Sampo, SBB, Turku Technology Properties, Varma, Veritas and Ylva.