Press release – 28 February 2019 at 14.00

The Finnish property investment market delivered a total return of 6.6% in 2018, reflecting an income return of 5.3% and capital growth of 1.3%. Of the property sectors, residential properties delivered the highest total return while retail delivered the weakest.

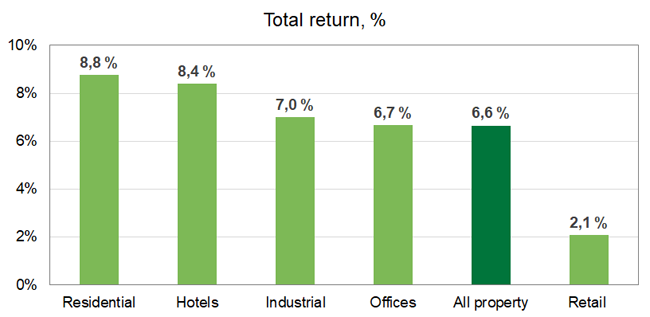

Total returns by property sector in 2018

Total returns by property sector in 2018

Residential properties back on top

Of the main property sectors, residential properties delivered the best returns for nine consecutive years between 2008 and 2016. After a year’s break, institutional residential property investments returned to the top position in 2018 with a total return of 8.8%. Hotels and industrial property investments also made it to the top three with total returns of 8.4% and 7.0%, respectively. Offices delivered a total return of 6.7%, virtually in line with the market average, whereas the total return of retail properties reached only 2.1%.

Residential income returns edged higher

Income returns for residential property investments edged slightly higher in 2018 on the back of higher rental income and occupancy rates. For Finland as a whole, the occupancy rate in residential properties averaged 97%. Residential returns in the Helsinki metropolitan area as well as in other major cities (Tampere, Turku, Jyväskylä, Oulu, Kuopio and Lahti) were somewhat higher than in the rest of the country supported by higher capital returns. The residential rental market has in recent years attracted more capital from institutional investors leaving residential as the largest sector in the Finnish institutional property investment market and with a 44% share of the KTI Index in 2018.

Record-low income returns for offices

Total returns for offices fell by one percentage point from last year to 6.7% in 2018. Positive contributions to capital values from lower yields and higher rental income were offset by higher operational and maintenance costs as well as capital expenditure needed to attract tenants. Overall occupancy rates improved somewhat averaging 84% in 2018 for Finland as a whole. The average income return for Finnish offices reached new record lows dropping below 5% for the first time in the history of the KTI Index. The lower returns reflect both continued high levels of interest towards higher valued properties with core characteristics as well as lower utilisation rates and higher costs.

Offices in Helsinki CBD outperformed by offices in the rest of the Helsinki metropolitan area

Office returns in Helsinki CBD fell from the record levels of 2017, leaving the total return at 4%, reflecting only marginal capital returns and a record-low income return. In contrast, offices in the rest of the Helsinki metropolitan area delivered a total return of close to 9% supported by strong capital growth. Outside the Helsinki metropolitan area capital values for offices outside continued to show declines in capital values on average.

Retail property values continued to head lower

In the retail property investment market, total return fell to 2.1% from 3.7% in 2017. Returns for shopping centre properties fell below the returns of other retail properties due to declining capital values also in the Helsinki metropolitan area. For other retail properties, capital values increased in the Helsinki metropolitan area and declined in other parts of Finland.

Hotel properties continued to show strong returns

The attractiveness of hotel properties has remained strong in the investment market in recent years. Hotel properties outperformed other sectors in both 2016 and 2017, and 2018 saw total returns expand further supported by a stable income return and higher capital values. Also for hotel properties, the Helsinki metropolitan area delivered higher returns compared to the rest of the country.

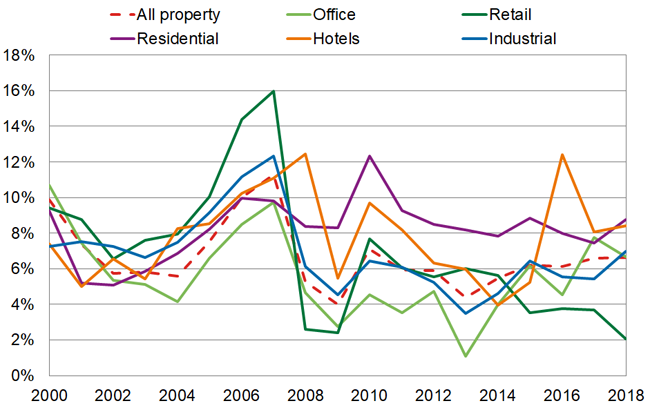

Total return by property sector 2000–2018

For further information, please contact:

Markus Steinby, tel. +358 50 464 7587

Hanna Kaleva, tel. +358 40 555 5269

KTI Finland is an independent research organisation and service company providing information and research services for the Finnish real estate industry. KTI Finland has calculated the KTI Index since 1998 and it reflects the total return of annual income and capital returns on property investments. In 2018, 26 property investors contributed to the KTI Index and the database covers some €24 billion worth of properties.

The contributors to the KTI Index include: Aberdeen Standard Investments, Ahlström Capital, Castellum, CBRE Global Investors, Alma Property Partners, Areim Fastigheter, Avara, Avain Vuokrakodit, Citycon, Elo, Exilion Management, Genesta, HYY Real Estate, Ilmarinen, Julius Tallberg Real Estate Corporation, Keva, Kojamo, LocalTapiola, Mercada, Renor, Sampo, SATO, Tarkala-Rettig Kiinteistökehitys, Turku Technology Properties, Varma and Veritas.