January 16, 2024

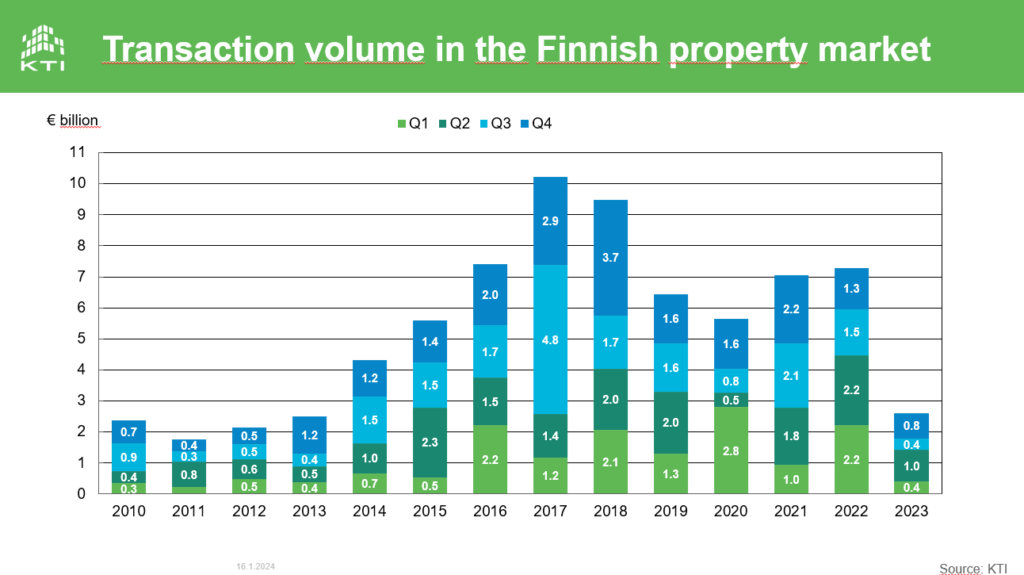

According to the KTI statistics, the property transaction volume amounted to €2.6 billion in 2023, which was the lowest volume since 2013. Both in 2021 and 2022, the annual volume exceeded €7 billion. The average size of the transactions was clearly lower compared to previous years, and the number of transactions decreased markedly. In 2023, approximately 180 professional property transactions exceeding one million euro were carried out, while in previous years the number has varied between 250-350 transactions.

In the last quarter of the year, transaction volume amounted to €820 million, which was 38% lower than in the corresponding period in 2022. The highest quarterly volume in 2023 was recorded in April-June, which was the only quarter when the volume exceeded €1 billion. Both in the first and third quarters, the volume remained at only about €400 million.

Residential properties the most traded property sector

Residential properties were the most traded property sector for the third consecutive year, accounting for 27% of the total volume in 2023. However, the volume of residential property transactions only amounted to slightly over €700 million, which was the lowest volume in this sector since 2014. The largest residential portfolio transaction of the year was recorded in late spring, when the US investor KKR acquired 1,200 rental apartments across Finland from Kruunuasunnot. Avant Capital Partners acted as KKR’s investment partner in the transaction.

Both industrial and public use properties accounted for 22% of the total volume. In the industrial property sector, the volume was boosted especially by logistics property transactions. Public use property transaction volume decreased by 65% compared to record-high volume of 2022, but a couple of large public use property portfolios were sold also in 2023. In the last quarter of 2023, eQ Community Properties Fund sold two care property portfolios to Nrep and Northern Horizon’s fund for a total price of approximately €175 million. Also Kinland was active in the transaction market in 2023.

Office and retail property transaction volumes remained low, and they accounted for 17% and 10% of the total volume, respectively. Swedish investor Niam acquired three significant office assets in Finland in 2023 and was the most active player in the office market.

Foreign investors carried out transactions in all property sectors

Foreign investors continued to be active in all property sectors in 2023. In total, foreign investors acquired properties worth over €1.4 bn, while their sales totalled less than €0.5 bn. More than half of foreign investors’ investments were originated from other Nordic countries. KKR was the only newcomer, who entered the Finnish market during the year. Of the domestic property investor groups, property funds were, once again, the most active buyers, accounting for 21% of the total volume. The shares of other domestic investor groups remained low.

More detailed information and analysis on property transactions in Finland can be found in the KTI Transactions information service. For more information, contact: Mikko Soutamo (mikko.soutamo(a)kti.fi, +358 50 548 0480).