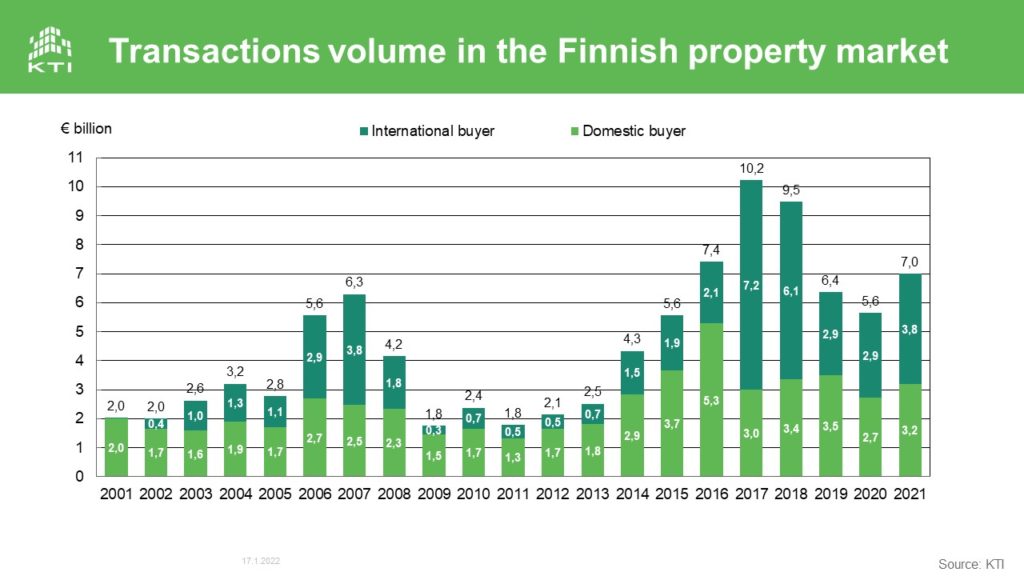

According to the statistics of KTI, the transaction volume in the Finnish property market amounted to €7.0 bn in 2021. The volume increased by 24% from the previous year, and by 10% compared to 2019. Transaction activity was especially high in the latter half of the year, when Q3 and Q4 transaction volumes reached €2.1 billion and €2.2 billion, respectively. Also the number of transactions increased markedly: in 2021, approximately 340 property transactions exceeding one million euro were carried out, compared to 260 transactions in 2020.

The largest transaction of the year was the acquisition of Kielo’s office property portfolio by Castellum for €640 million. The portfolio comprised 22 office properties in the Helsinki metropolitan area, Tampere, Turku, Jyväskylä and Lahti. The second largest transaction of 2021 was completed by CapMan’s new residential property fund, who bought 1,854 rental apartments from ICECAPITAL. The transaction price amounted to over €500 million.

Residential the most traded property sector

Residential properties and portfolios were the most traded property sector in 2021, accounting for 33% of the total volume (€2.3 billion), followed by office properties (29%), industrial properties (15%) and public use properties (13%). Retail property sector has suffered the most from the pandemic, and the volume of retail property transactions decreased to some €700 million in 2021, corresponding to approximately 10% of the total volume.

Share of foreign investors amounted to 54%

International investor interest in the Finnish property market has remained strong. In 2021, foreign investors completed large transactions in all main property sectors and accounted for 54% of the total volume. In total, foreign investors acquired properties worth €3.8 bn, while their sales totalled €1.8 bn in 2021. About half a dozen new foreign property investors entered the Finnish market during the year. Over 60% of foreign investors’ investments were originated from other Nordic countries, mainly by operators who have their own local organisations in Finland. Of the domestic property investor groups, property funds were the most active buyers, accounting for 29% of the total volume.

More detailed information and analysis on property transactions in Finland can be found in the KTI Transactions information service. For more information, contact: Mikko Soutamo (mikko.soutamo(a)kti.fi, +358 50 548 0480) or Olli-Pekka Virkola (olli-pekka.virkola(a)kti.fi, +358 50 330 5287).