16 January 2025

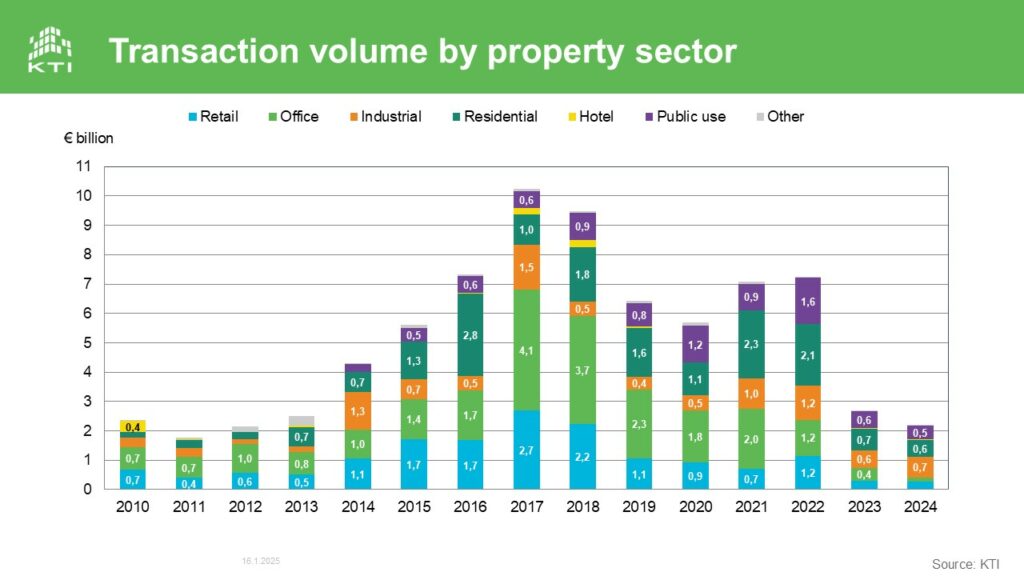

Property transaction market remained quiet in Finland in 2024. According to the KTI statistics, property transaction volume amounted to only €2.2 billion in 2024, and decreased by 18 per cent compared to the previous year. The transaction volume dropped to the same level as in early 2010’s, although the total size of the Finnish property investment market has doubled during the past decade.

The highest quarterly volume in 2024, over €800 million, was recorded in Q2. In the last quarter of the year, transaction volume just exceeded €500 million, which was almost 40 per cent less than in the corresponding period in 2023.

Industrial properties the most traded property sector, office transaction volume historically low

Industrial properties were the most traded property sector, accounting for 31 per cent of the total volume in 2024. Industrial was also the only property sector, where transaction volume increased compared to 2023. The volume of industrial property transactions amounted to approximately €700 million, which included both portfolio sales as well as individual acquisitions of both large logistics centres and smaller industrial properties. The largest transaction of the year took place in the summer, when a fund managed by Blackstone acquired a portfolio of 22 industrial properties from Aktiivihallit for €135 million.

Residential properties were the most traded property sector in three previous years. In 2024, residential properties accounted for 26 per cent of the total volume. The share of public use property transactions remained stable at 21 per cent of the total volume, while the share of retail properties amounted to 12 per cent. Office property transaction volume dropped to historically low level in 2024, amounting to only some €150 million. The share of office properties decreased to only 7 per cent of the total volume.

Foreign investors remained as net buyers

Foreign investors completed transactions in all main property sectors in 2024. Their share of the total volume decreased from 59 per cent in 2023 to 45 per cent in 2024, but they remained net buyers also in 2024. In total, foreign investors acquired properties in Finland for some €1.0 billion, while their sales totalled approximately €400 million.

Of the domestic property investor groups, property investment companies were most active buyers, accounting for 16% of the total volume, while domestic property funds were net sellers for the second consecutive year. The funds acquired properties worth only some €300 million and sold for some €600 million in 2024. Special investment funds, in particular, changed from net buyers to net sellers.

More detailed information and analysis on property transactions in Finland can be found in the KTI Transactions information service. For more information, contact: Mikko Soutamo (+358 50 548 0480, mikko.soutamo(a)kti.fi,) or Olli-Pekka Virkola (+358 50 330 5287, olli-pekka.virkola(a)kti.fi).