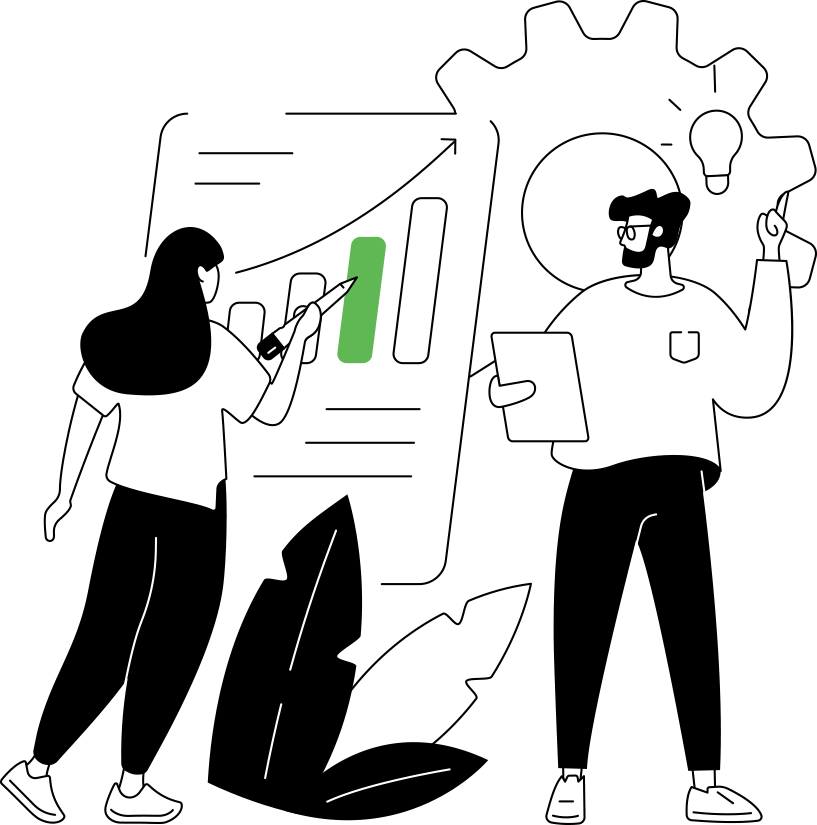

Total return on the Finnish property investment market amounted to 6.6% in 2017. Income return continued to decrease and stood at 5.4%. Capital growth amounted to 1.2% on average. In all property sectors, the Helsinki metropolitan area outperformed other parts of the country.

Returns by sector in 2017

Residential properties continued to perform well

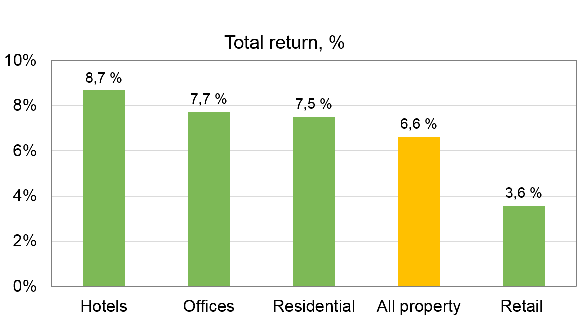

Of the main property sectors, residential properties delivered the best returns for nine consecutive years between 2008 and 2016. In 2017, residential continued to perform well, but lost its top position for hotels and offices. Total return for residential properties amounted to 7.5% in 2017 (8.0% in 2016). Other major cities (Tampere, Turku, Jyväskylä, Oulu, Kuopio and Lahti) and the Helsinki metropolitan area outperformed the rest of Finland due to the negative capital growth outside the main cities.

Capital growth for residential properties decreased slightly from previous years. However, supported by both increasing rents and strong occupancy rate, income return increased slightly in 2017 compared to the previous year. Occupancy rate for residential properties stood at 96.5% in 2017 on average.

Professional investors have increased their investments in rental residential properties in recent years, and residential is currently the largest sector in the Finnish property investment market. Its share of the KTI Index database stood at 41% in 2017.

Total return for offices strengthened in 2017

Offices outperformed the other main property sectors in 2017 with a total return of 7.7%. Supported by decreasing yields, capital growth turned positive after several years of sluggish development. Income return continued to decrease due to both low occupancy rate and increasing costs. Occupancy rate for offices stood at 82.6% in 2017. Also, professional investors’ concentration on higher-quality assets with higher market values and lower yields has decreased the level of income return.

Investment performance continued to be strongest for Helsinki CBD offices, with total return exceeding 14% in 2017 – the highest annual return in the KTI Index history. Supported by high returns in the CBD, the total return for the Helsinki metropolitan area offices exceeded 8%. For the main cities outside the Helsinki metropolitan area as well as for the rest of Finland, capital growth for offices remained negative.

Capital values for retail properties decreased outside the Helsinki metropolitan area

In the retail property investment market, total return remained low at 3.6%. Geographical differences were, however, emphasized in the retail property markets: for the Helsinki metropolitan area the total return exceeded 7% mainly due to the strong performance of shopping centre properties. In the metropolitan area, capital growth of shopping centre properties was supported by both decreasing yields and increasing rental values. For other retail properties in the Helsinki metropolitan area, as well as for both shopping centres and other retail properties outside the metropolitan area, capital growth was negative in 2017.

Hotel properties delivered the best returns in 2017

The attractiveness of hotel properties has increased in the investment markets in recent years, and the hotel property stock has increased in the Helsinki metropolitan area in particular. In 2017, hotel properties delivered the highest total return among all sectors, amounting to 8.7%. Also in the hotel property market, the Helsinki metropolitan area clearly outperforms the rest of Finland.

Total return by property sector 2000–2017

For further information please contact: Pia Louekoski, tel. +358 400 959634 and Hanna Kaleva, tel. +358 40 555 5269

KTI Finland is an independent research organisation and service company providing information and research services for the Finnish real estate industry. KTI Finland has been calculating the KTI Index since 1998. 28 property investors contribute to the KTI Index. The database currently comprises some €25.5 billion worth of properties, thus covering about 40% of the total property investment market in Finland.

The contributors to the KTI Index include: Aberdeen Asset Management, Ahlström Capital, Alma Property Partners, Areim Fastigheter, Avara, Avain Vuokrakodit, Barings Real Estate Advisers, Citycon, Elo, eQAsset Management, Etera, Exilion Management, Genesta, HYY Real Estate, Ilmarinen, Julius Tallberg-Kiinteistöt, Keva, Kojamo, LocalTapiola, Mercada, OP, Renor, Sampo Group, SATO, Tarkala-Rettig Kiinteistökehitys, Turku Technology Properties, Varma and Veritas.