Press release 6 March 2024

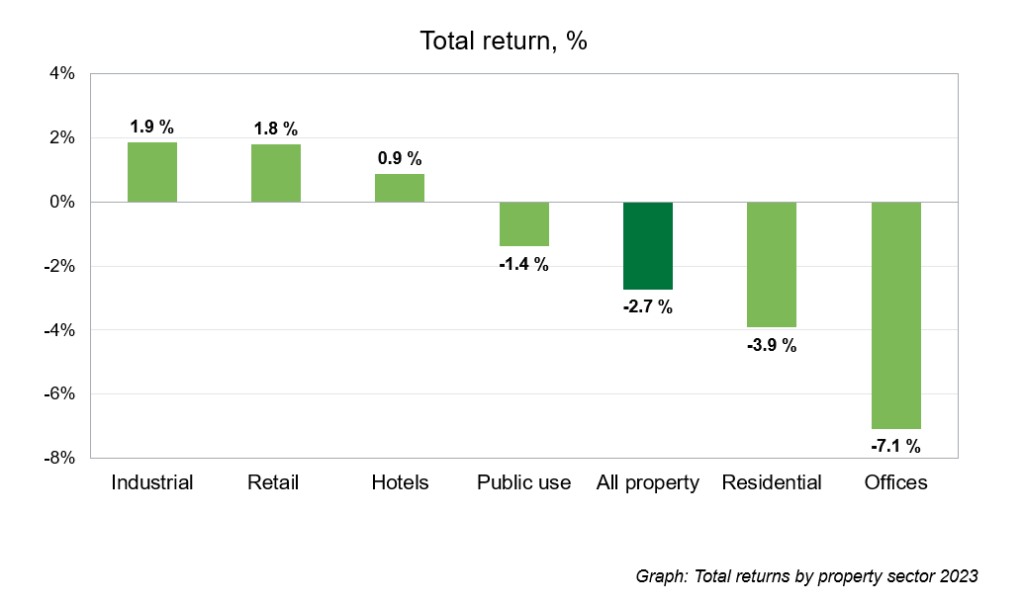

According to the KTI Property Index, the total return on properties owned by professional property investors fell to -2.7 per cent in 2023. The market values of investment properties decreased by an average of 7 per cent. The annual net income turned up after a decline of almost a decade and was 4.6 per cent in 2023.

The KTI Property Index results are based on 51 professionally managed real estate investment portfolios with a total value of approximately 37 billion euros. The index covers 39 per cent of the total property investment universe in Finland. The Index reflects the total return on properties held throughout the whole year and comprises annual net income and capital growth.

The first negative annual total return in the history of the Index

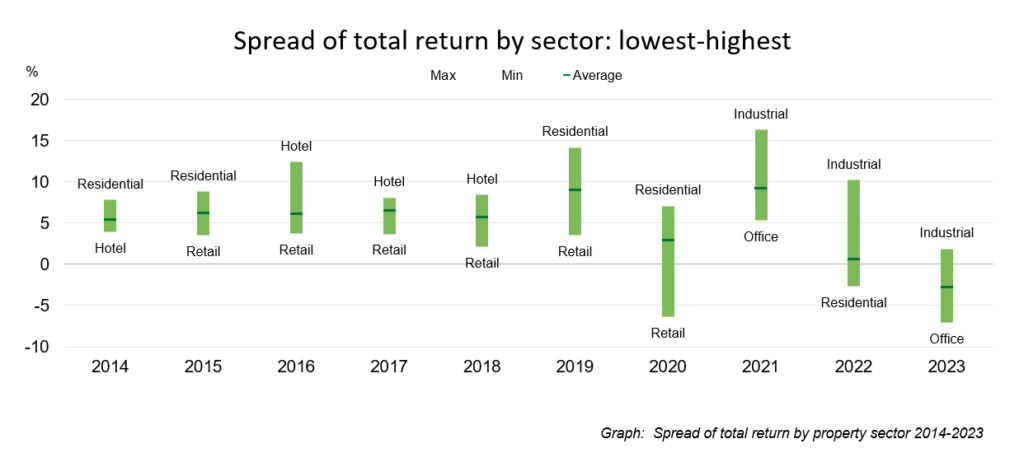

The result recorded for 2023 was the first negative total return in the more than 20-year history of the KTI Property Index. The market values declined in all property sectors, as the rising interest rate raised the yields for property investments and increasing uncertainty froze the property investment market. On the other hand, the net income on property investments increased, as indexations increased rents measured in euros. Falling market values also supported the increase in the annual income return.

Residential property values continued to decline

Residential is the largest sector of the professional property investment market, accounting for approximately 35 per cent of the total invested market. The total return on residential properties was negative for the second consecutive year and fell to -3.9 per cent in 2023. The market values of residential properties in the KTI Property Index have now declined by an average of almost 13 per cent from their peak at the end of 2021. Above all, market values are weighed down by the increase in yields: in the Index, the valuation yield for residential properties have risen by well over a hundred basis points in the last two years. The net income on residential properties increased slightly from the previous year, as rents increased and market values decreased. On the other hand, a weak average occupation rate of less than 93 per cent, as well as increasing maintenance costs weighed on net income. However, the increase in the supply of new and high-quality rental dwellings, as well as the sharply reduced construction volume since 2022 strengthen the outlook for residential rents and occupancy rates in the coming years.

Total return on office properties at all-time low

The total return for office properties fell to -7.1 percent, which is the lowest ever sector-level annual return in the history of the KTI Property Index. The decline in market values of office properties reached double digits in 2023, as the yields increased in the best locations in particular. Uncertainty in demand for office space is partly weighing on market values, and rentability of space requires continuous investments from the owners. The change in demand is also illustrated in the high amount of vacant office space: in the office properties covered by the Index, the average occupancy rate fell to 83 per cent in 2023.

Retail and industrial properties produced positive total returns

The total return on retail properties amounted to 1.8 per cent in 2023. Market values of both shopping centre and other retail properties decreased, but more moderately than in any other property sector. Income return remained healthy and kept the sector’s total return on the positive territory.

Industrial property sector, comprising different types of logistics, warehouse and manufacturing properties, narrowly outperformed the retail sector with a total return of 1.9 per cent. The impact of increasing yields was milder and rental outlook remained more positive than in other property sectors. Higher income returns typical of industrial properties also supported the total return. Industrial was the best performing property sector for the third consecutive year.

Total return on public use properties fell negative

The public use property sector, which has grown strongly in recent years, includes, for example, various kinds of care, educational and healthcare properties. Also in the public use property sector, the decline in market values pushed the total return into negative territory, to -1.4 per cent in 2023. Of the various subsectors, the market values of healthcare properties fell the most, while the values of educational real estate held their ground the best. The high occupancy rate of over 98 per cent and the increase in rents maintained the sector’s net income at a healthy level.

For more information:

Hanna Kaleva, Managing director, KTI, +358 40 5555 269

KTI is an independent market information and research service company servicing the professional property investment sector in Finland.