Press release, 4 March 2022

Total return on the Finnish property investment market amounted to 9.2% in 2021. This was the highest annual return since 2007 and the fourth highest in the history of the KTI Property Index dating back to 2000. Total return was boosted by a capital growth of 4.8%, while net income remained stable at 4.3%. The changes caused by the COVID-19 pandemic on property investment and rental demand were reflected in significant differences between the returns on various property sectors.

KTI Property Index results are based on the portfolios of 26 professional property investors, with a total property portfolio value of approximately €36 billion. The Index covers 40% of the total property investment universe. The Index reflects the total return on properties held throughout the whole year and comprises annual net income and capital growth.

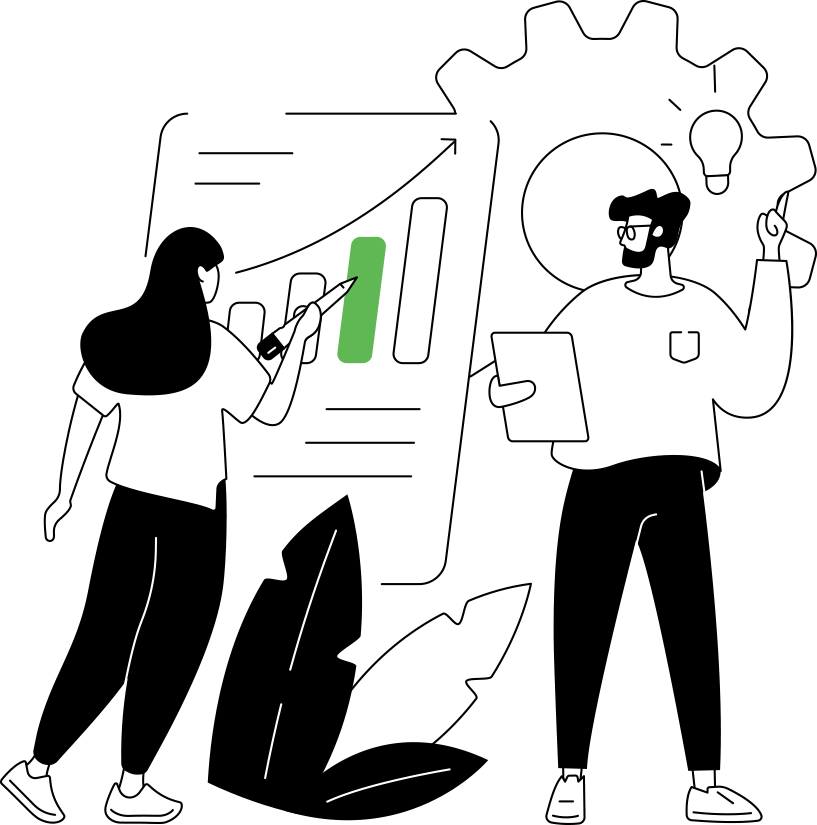

Total return by property sector in 2021

Source: KTI Index

Capital growth positive for all sectors in 2021

The differences in returns between the property sectors are mainly explained by the large differences in the development of market values. However, after several years, the capital growth turned positive in all sectors in 2021. The largest increases in market values of approximately 9% were recorded for industrial and residential properties. On the other hand, market values increased the least, by approximately one per cent, in office and retail property sectors.

Spread of total return by property sector 2010-2021

Source: KTI Index

The highest annual total return on industrial properties ever

In 2021, the best total return was produced by the industrial property sector, which comprises logistics, warehousing and manufacturing properties. Demand for logistics properties in particular has strengthened in both the investment and rental markets during the pandemic, which is reflected in declining yields and increasing market values. The annual total return on industrial properties was higher than in any real estate sector in the whole history of the KTI Index, 16.3%. The total return on industrial properties is also supported by a higher net income than in other property sectors.

Residential properties continue to produce strong returns

In recent years, residential properties have strengthened their position as the largest sector in the property investment market, driven by stable rental demand and the strong development of market values. Although the pandemic has partly softened rental demand, strong returns reflect investors’ confidence that challenges will remain temporary. In 2021, residential properties generated a total return of 12.8%. The sector’s net income fell below 4% for the first time in 2020, and the decline continued in 2021. The decline in net income was due to an increase in market values on the one hand and a decrease in occupation rate of just over one percentage point on the other.

Healthy return on public use properties, pandemic challenges office, retail and hotel sectors

Professional investors currently own almost €8 billion worth of public use properties, i.e., various nursing home, educational, healthcare and other service properties, which are needed to provide public services. In 2021, public use properties generated a total return of 9.9%. Lower-than-average returns were provided by the large office and retail property sectors, whose investment prospects have been challenged by the pandemic over the past two years. In both sectors, there also are large differences within the sector depending on the type, quality and location of the property. The total return on retail properties rose to almost six per cent in 2021 after a deep slump in 2020, as the capital growth turned positive and the improved occupancy rate supported net income. The total return on office properties also improved from the previous year and was 5.3%. Hotel properties generated a total return of 5.5% in 2021, as capital growth returned to positive territory, but net income continued to fall.

For further information, please contact:

Pia Louekoski, director, KTI Property Information Ltd, +358 400 959 634

Hanna Kaleva, managing director, KTI Property Information ltd, +358 40 5555 269

KTI is an independent market information and research service company servicing the professional property investment sector in Finland.

Contributors for the KTI Index in 2021: Akiva Kiinteistöt I Ky, Erikoissijoitusrahasto Aktia Toimitilakiinteistöt, Antilooppi, CBRE Global Investors, Areim Fastigheter, Avara, Avain Vuokrakodit, Citycon, Elo, eQ, Exilion Management, Evli, Ilmarinen, Julius Tallberg-Kiinteistöt, Keva, Kojamo, LocalTapiola, Mercada, Niam, OP Property Investment, SBB, Turku Technology Properties, Varma, Vantaan Valo, Varma, Veritas and Ylva.