Press release 6.3.2025

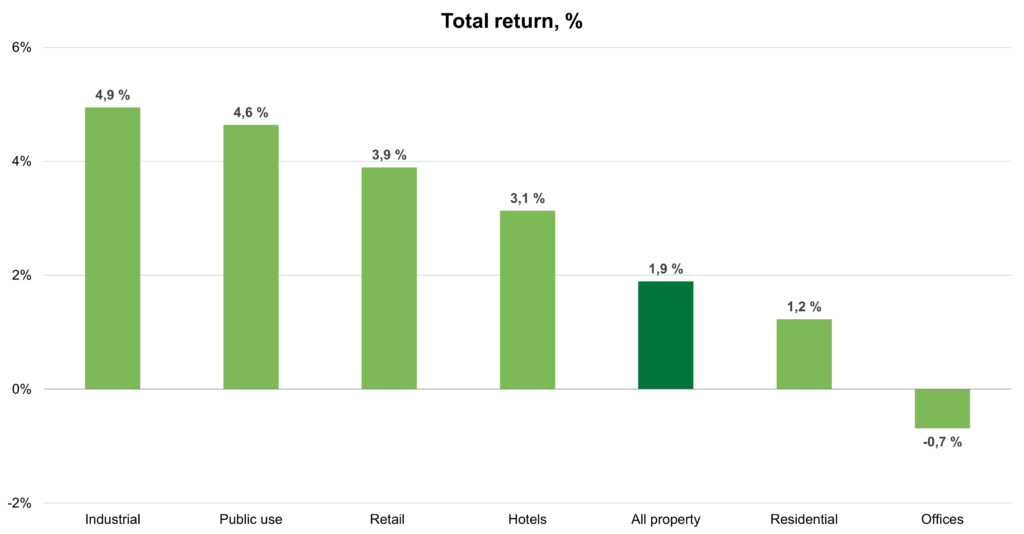

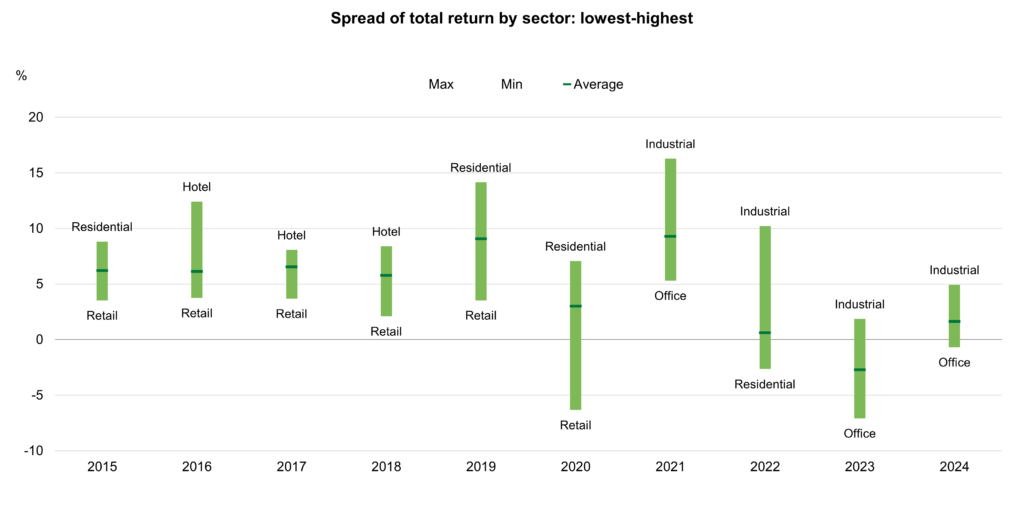

The total return on properties owned by professional investors rose to 1.9% in 2024. The decline in the market values of investment properties continued, but at a slower pace than in the previous two years. The income return increased to 4.8% on average, supported by the declining market values. The weaker-than-average performance of the two largest property sectors – residential and office properties – weighed on the overall returns of property investments.

The results of the KTI Property Index are based on 54 professionally managed real estate investment portfolios in Finland with a total value of approximately 37 billion euros. The index covers 39% of the total invested property market in Finland. The KTI Property Index describes the total return on investment properties owned throughout the year, which comprises the annual realised net income and capital growth.

Decline in market values slowed down

The rise in interest rates has been weighing on the market values of investment properties since 2022. In 2024, the market values of the Finnish investment properties decreased by 2.8% on average. Although the development of interest rates stabilised during the year, the yields for properties still increased throughout 2024. In addition, the general uncertainty of space demand weighs on the market values of office properties in particular, where also rental growth prospects remain subdued. Rental value growth was the most positive for public use properties. Also in retail and residential property sectors, positive rental outlook supports the market values.

Total return on residential properties rose to 1.2%

Residential properties are the largest sector of the professional property investment market in Finland, accounting for approximately 35% of the total property investment universe. The significant decline in the market values of residential properties pulled the sector’s total returns into negative territory in 2022 and 2023. In 2024, the decline in values slowed down markedly, and the slightly increased income return pulled the total return into positive territory at 1.2%. In the Helsinki metropolitan area, both the capital growth and income return of residential properties were weaker than in the rest of the country. The average occupancy rate remained low, which continued to weigh on income return in the Helsinki metropolitan area. Among the major cities, the highest total return for residential properties in 2024 was recorded in Oulu.

Total return on office properties remained negative

As the only property sector, total return on office property investments remained in negative territory in 2024, ending at -0.7%. Due to increasing yields, the market values of office properties decreased more than in other property sectors. After a sharp drop in 2023, the decline in the market values of office properties in Helsinki CBD leveled off in 2024, but, due to a lower income return, CBD offices still underperformed the office properties in the whole country on average. The average returns for the office market are also weighed down by both non-existent rental growth expectations and the further decline in occupancy rates. Operational costs of office properties also continued to rise as attracting and retaining tenants requires more efforts from the landlords. However, the income return for the office sector increased from the previous year, supported by the decline in market values.

Industrial properties produced the highest returns for the fourth consecutive year

The attractiveness of industrial properties – various warehouse, logistics, and manufacturing properties – has strengthened in the Finnish property investment market in recent years. In 2024, industrial properties were the most traded sector in the transaction market, accounting for over 30% of the year’s total transaction volume. However, the sector’s share of the total real estate investment market remains at only approximately 8%. As in the previous three years, industrial properties were the best-performing real estate sector in 2024, with a total return of 4.9%. A strong income return was sufficient to compensate for the slightly negative capital growth.

Weak performance of shopping centres weighs on the returns of the retail property sector

The average total return on retail properties was 3.9% in 2024. The decline in the market values of the sector slowed to less than 2%. Unlike in other property sectors, the average income return of retail properties decreased in 2024, particularly due to the increased costs of shopping centre properties. Also the capital growth remained more negative for shopping centres than for other retail properties.

Market values of public use properties decreased the least

The public use property sector, which has grown markedly in recent years, includes, for instance, various nursing home, educational, and healthcare properties. The sector’s share of the total Finnish property investment market rose to nearly 10% in 2024. The total return on public use properties rose to 4.6% in 2024, as the decline in values slowed to approximately 1% on average. Supported by long-term leases and solvent tenants, the sector’s contract rents continued to rise, and the occupancy rate remained high at over 98%. Supported by a more moderate decline in market values, educational properties outperformed nursing home and healthcare properties in 2024.

For more information:

Hanna Kaleva, Managing director, KTI, +358 40 5555 269

KTI is an independent market information and research service company servicing the professional property investment sector in Finland.