Press release 2 March 2023

Total return on the Finnish property investment market amounted to 0.6 per cent in 2022. This was the lowest annual return ever in the history of the KTI Property Index dating back to 2000. The returns were weighed by a negative capital growth. Income return also continued to decline.

KTI Property Index results are based on the portfolios of 44 professionally managed property funds, with a total property portfolio value of approximately €35 billion. The Index covers 37% of the total property investment universe in Finland. The Index reflects the total return on properties held throughout the whole year and comprises annual net income and capital growth.

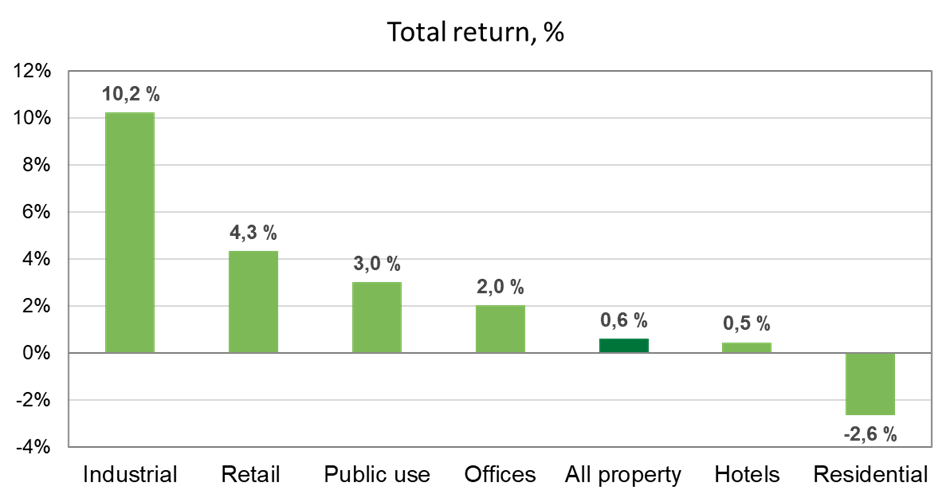

Total returns by property sector 2022

Market values declined, pressured by increasing yields

Market values of investment properties declined by 3.4 per cent on average in 2022. The annual decrease in values was the largest in the entire 23-year history of the Index. The rise in interest rates started to raise property yields in 2022, which was the main driver for the decline in values. The deterioration of the overall economic situation and the increase in uncertainty also increased pressure on the returns of property investments. The average annual income return amounted to 4.2 per cent in 2022.

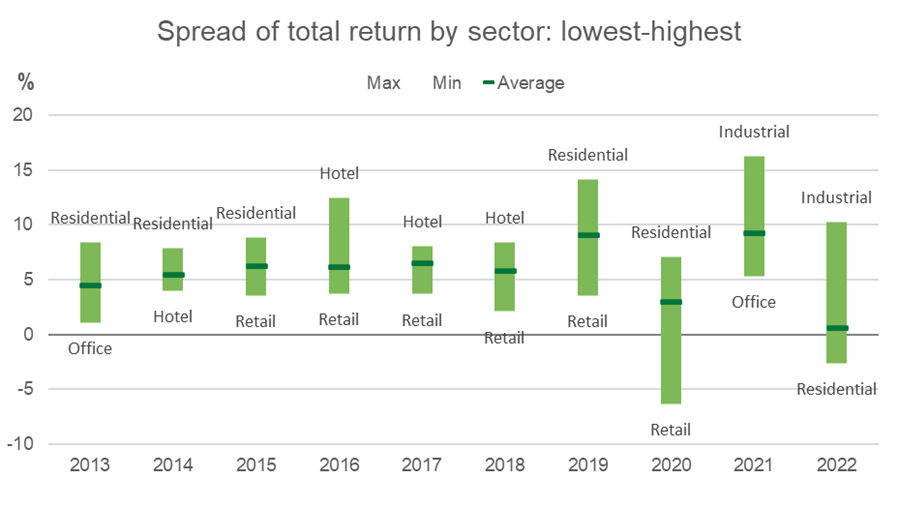

Spread of total return by property sector 2013-2022

Total return on residential properties at an all-time low

Residential is the largest sector in the Finnish real estate investment market. Supported by rising market values, residential properties have offered strong returns over the past decade. In 2022, however, market values of residential properties decreased for the first time in the history of the KTI Property Index. In recent years, the income return on residential properties has decreased year by year, mainly weighed by the increase in market values. In 2022, income returns were also pressured by the decline in occupancy rate, and the average income return of residential properties fell below 3.5 per cent. The total return on residential properties was the lowest of all sectors in 2022 and amounted to -2.6 per cent.

Industrial properties outperformed all other sectors for the second year in a row

Industrial properties were the only sector with a positive capital growth in 2022, and the sector produced the highest total returns for the second consecutive year. The total return of 10.2 per cent was supported by both a positive capital growth and a healthy income return of over 6 per cent. Of the various segments within the industrial property sector, the highest total return of nearly 13 per cent was produced by logistics properties, which account for more than 50 per cent of all industrial properties in the KTI Index database. Total return on warehouse and manufacturing properties was significantly lower than that of logistics properties.

Both market values and income returns of office and retail properties declined

The two traditional large commercial property sectors, office and retail properties, have in recent years been challenged by both the COVID-19 pandemic and the recent development in the financial markets. Total return on office properties amounted to 2 per cent in 2022, as market values decreased by over 2 per cent on average. The office market is characterised by an increasing polarisation between the most wanted prime properties and properties of lower quality and location. Even in the best properties, the tightening user requirements require increasing investments and refurbishments in order to maintain occupancy rates, which also weighs both market values and income returns.

For retail properties, capital growth turned negative again in 2022 after a temporary recovery in the previous year. However, thanks to a stable income return, total return remained healthy at 4.3 per cent. The capital growth of shopping centre properties was close to zero, while the market values of other retail properties declined by well over one per cent. However, the clearly higher income return kept the total return on other retail properties markedly higher than that of shopping centres.

Total return on public use properties weighed by increasing yields

The amount of public use properties – for example, nursing homes, educational, healthcare and other properties needed for public service properties – owned by professional investors is currently well over €9 billion. The total return on public use properties declined from almost 10 per cent in 2021 to 3 per cent in 2022. Also in the public use property sector, capital growth was negative for the first time ever, as yields increased due to the rise of interest rates. The income return remained healthy at over 5 per cent.

For more information:

Kasper Joukama, Director, KTI, +358 400 764 547

Hanna Kaleva, Managing director, KTI, +358 40 5555 269

KTI is an independent market information and research service company servicing the professional property investment sector in Finland.