Together with key real estate fund managers and Rakli, KTI has today published the 2023 Special Investment Fund Review. The review contains the most important information and key figures for 2022 on special investment funds investing in real estate.

Continue readingThe Finnish Property Market 2025 report has been published

The Finnish Property Market 2025 report has been published.

View the flyer here.

Order The Finnish Property Market full report from here (free of charge).

Orders for printed reports and other matters, please contact us at kti@kti.fi or tel. +358 20 7430 130.

KTI Property Index: The total return on property investments turned positive despite the continued decline in market values in 2024

Press release 6.3.2025

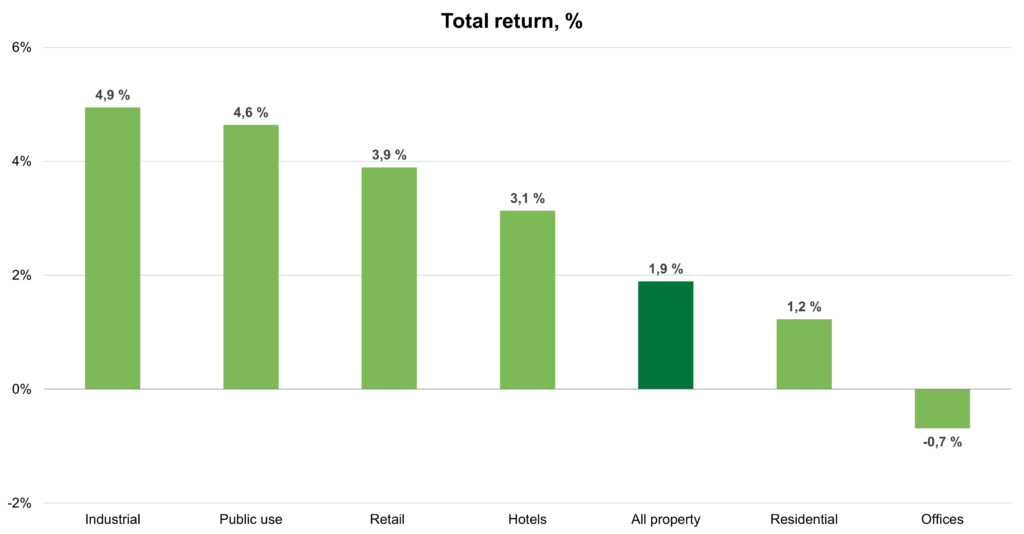

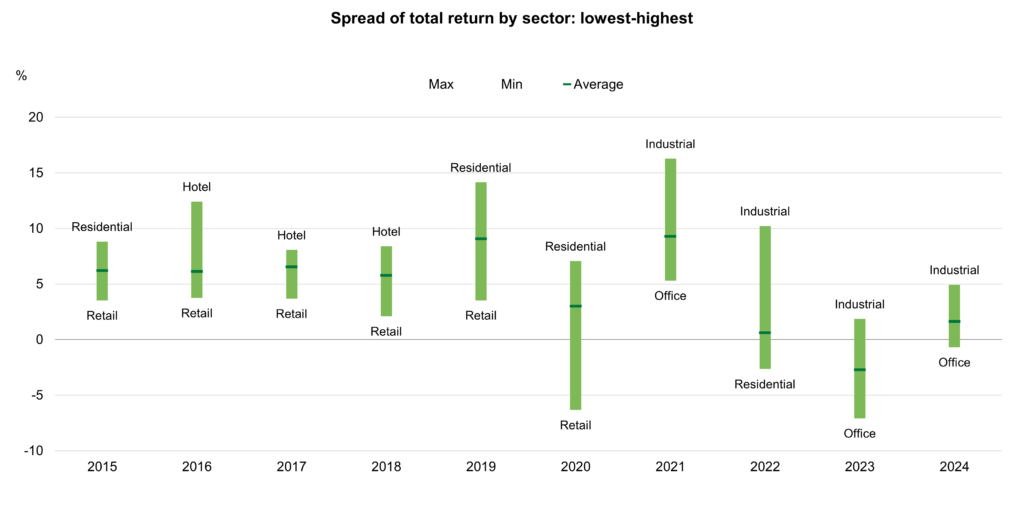

The total return on properties owned by professional investors rose to 1.9% in 2024. The decline in the market values of investment properties continued, but at a slower pace than in the previous two years. The income return increased to 4.8% on average, supported by the declining market values. The weaker-than-average performance of the two largest property sectors – residential and office properties – weighed on the overall returns of property investments.

The results of the KTI Property Index are based on 54 professionally managed real estate investment portfolios in Finland with a total value of approximately 37 billion euros. The index covers 39% of the total invested property market in Finland. The KTI Property Index describes the total return on investment properties owned throughout the year, which comprises the annual realised net income and capital growth.

Decline in market values slowed down

The rise in interest rates has been weighing on the market values of investment properties since 2022. In 2024, the market values of the Finnish investment properties decreased by 2.8% on average. Although the development of interest rates stabilised during the year, the yields for properties still increased throughout 2024. In addition, the general uncertainty of space demand weighs on the market values of office properties in particular, where also rental growth prospects remain subdued. Rental value growth was the most positive for public use properties. Also in retail and residential property sectors, positive rental outlook supports the market values.

Total return on residential properties rose to 1.2%

Residential properties are the largest sector of the professional property investment market in Finland, accounting for approximately 35% of the total property investment universe. The significant decline in the market values of residential properties pulled the sector’s total returns into negative territory in 2022 and 2023. In 2024, the decline in values slowed down markedly, and the slightly increased income return pulled the total return into positive territory at 1.2%. In the Helsinki metropolitan area, both the capital growth and income return of residential properties were weaker than in the rest of the country. The average occupancy rate remained low, which continued to weigh on income return in the Helsinki metropolitan area. Among the major cities, the highest total return for residential properties in 2024 was recorded in Oulu.

Total return on office properties remained negative

As the only property sector, total return on office property investments remained in negative territory in 2024, ending at -0.7%. Due to increasing yields, the market values of office properties decreased more than in other property sectors. After a sharp drop in 2023, the decline in the market values of office properties in Helsinki CBD leveled off in 2024, but, due to a lower income return, CBD offices still underperformed the office properties in the whole country on average. The average returns for the office market are also weighed down by both non-existent rental growth expectations and the further decline in occupancy rates. Operational costs of office properties also continued to rise as attracting and retaining tenants requires more efforts from the landlords. However, the income return for the office sector increased from the previous year, supported by the decline in market values.

Industrial properties produced the highest returns for the fourth consecutive year

The attractiveness of industrial properties – various warehouse, logistics, and manufacturing properties – has strengthened in the Finnish property investment market in recent years. In 2024, industrial properties were the most traded sector in the transaction market, accounting for over 30% of the year’s total transaction volume. However, the sector’s share of the total real estate investment market remains at only approximately 8%. As in the previous three years, industrial properties were the best-performing real estate sector in 2024, with a total return of 4.9%. A strong income return was sufficient to compensate for the slightly negative capital growth.

Weak performance of shopping centres weighs on the returns of the retail property sector

The average total return on retail properties was 3.9% in 2024. The decline in the market values of the sector slowed to less than 2%. Unlike in other property sectors, the average income return of retail properties decreased in 2024, particularly due to the increased costs of shopping centre properties. Also the capital growth remained more negative for shopping centres than for other retail properties.

Market values of public use properties decreased the least

The public use property sector, which has grown markedly in recent years, includes, for instance, various nursing home, educational, and healthcare properties. The sector’s share of the total Finnish property investment market rose to nearly 10% in 2024. The total return on public use properties rose to 4.6% in 2024, as the decline in values slowed to approximately 1% on average. Supported by long-term leases and solvent tenants, the sector’s contract rents continued to rise, and the occupancy rate remained high at over 98%. Supported by a more moderate decline in market values, educational properties outperformed nursing home and healthcare properties in 2024.

For more information:

Hanna Kaleva, Managing director, KTI, +358 40 5555 269

KTI is an independent market information and research service company servicing the professional property investment sector in Finland.

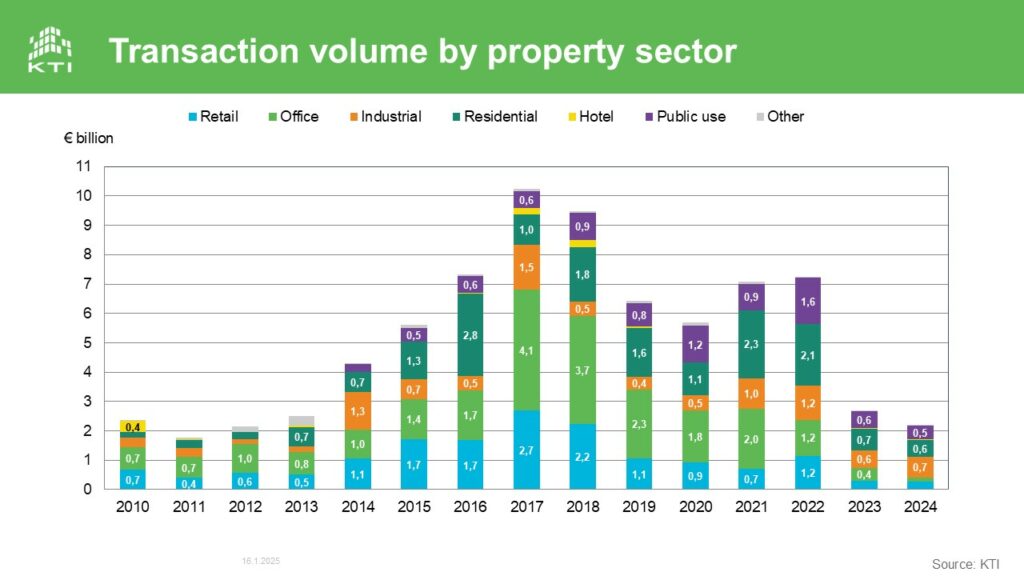

Transaction volume fell to €2.2 billion in 2024

16 January 2025

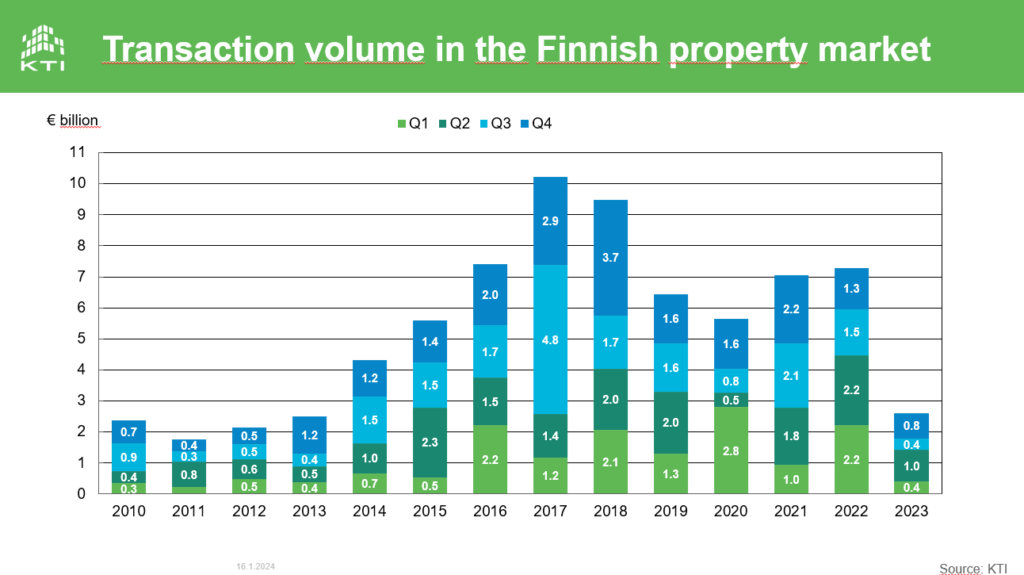

Property transaction market remained quiet in Finland in 2024. According to the KTI statistics, property transaction volume amounted to only €2.2 billion in 2024, and decreased by 18 per cent compared to the previous year. The transaction volume dropped to the same level as in early 2010’s, although the total size of the Finnish property investment market has doubled during the past decade.

The highest quarterly volume in 2024, over €800 million, was recorded in Q2. In the last quarter of the year, transaction volume just exceeded €500 million, which was almost 40 per cent less than in the corresponding period in 2023.

Industrial properties the most traded property sector, office transaction volume historically low

Industrial properties were the most traded property sector, accounting for 31 per cent of the total volume in 2024. Industrial was also the only property sector, where transaction volume increased compared to 2023. The volume of industrial property transactions amounted to approximately €700 million, which included both portfolio sales as well as individual acquisitions of both large logistics centres and smaller industrial properties. The largest transaction of the year took place in the summer, when a fund managed by Blackstone acquired a portfolio of 22 industrial properties from Aktiivihallit for €135 million.

Residential properties were the most traded property sector in three previous years. In 2024, residential properties accounted for 26 per cent of the total volume. The share of public use property transactions remained stable at 21 per cent of the total volume, while the share of retail properties amounted to 12 per cent. Office property transaction volume dropped to historically low level in 2024, amounting to only some €150 million. The share of office properties decreased to only 7 per cent of the total volume.

Foreign investors remained as net buyers

Foreign investors completed transactions in all main property sectors in 2024. Their share of the total volume decreased from 59 per cent in 2023 to 45 per cent in 2024, but they remained net buyers also in 2024. In total, foreign investors acquired properties in Finland for some €1.0 billion, while their sales totalled approximately €400 million.

Of the domestic property investor groups, property investment companies were most active buyers, accounting for 16% of the total volume, while domestic property funds were net sellers for the second consecutive year. The funds acquired properties worth only some €300 million and sold for some €600 million in 2024. Special investment funds, in particular, changed from net buyers to net sellers.

More detailed information and analysis on property transactions in Finland can be found in the KTI Transactions information service. For more information, contact: Mikko Soutamo (+358 50 548 0480, mikko.soutamo(a)kti.fi,) or Olli-Pekka Virkola (+358 50 330 5287, olli-pekka.virkola(a)kti.fi).

KTI Market Review: Finnish property market activity remains low – gradual recovery expected

Published 6.11.2024

KTI Market Review, autumn 2024, has been published today. The overall sentiment in the Finnish property market is still subdued, but cautious signs of recovery are emerging across several fronts. The gradually improving economic situation as well as the decrease in interest rates are fostering optimism and provide a more stable foundation for the recovery in the property market. However, despite expectations for a revival in property transactions following the record-low activity of 2023, the first three quarters of this year have proven even quieter. Transaction volumes remain particularly low in the traditional large commercial property sectors – office and retail properties – whereas residential and industrial properties attract more investors, reflecting the outlook for space demand in various sectors. Transaction activity is expected to pick up within the next year, as market professionals anticipate foreign investor demand in particular to increase markedly in the near future.

Read more about the development and outlook of the real estate market in the KTI Market Review.

More information:

Hanna Kaleva

hanna.kaleva@kti.fi, p. 040 5555 269

Mikko Soutamo

+358 50 5480 480, mikko.soutamo@kti.fi

KTI Special Investment Funds Review Autumn 2024 has been published

Together with key real estate fund managers and Rakli, KTI has today published the 2023 Special Investment Fund Review. The review contains the most important information and key figures for 2022 on special investment funds investing in real estate.

Continue readingKTI Market Review and Rakli-KTI Commercial Property Barometer spring 2024: Property investment market activity remains low

2024 has witnessed a slow start in the Finnish property transaction market. The market values of investment properties have decreased in all sectors since the latter half of 2022. It is now estimated that the decrease in values will gradually bring the price perceptions of potential buyers and sellers closer together and thereby support the execution of transactions – but only if interest rates start to decrease as expected. The current economic situation creates pressures in the rental market. The demand for office properties is weighed down by both the weak economic development and the decreasing space needs among occupiers, which weakens the position of office properties in the investment market. The rental residential market is pressured by the oversupply of rental housing in the Helsinki metropolitan area, which is, however, expected to ease fairly soon due to the sharp decline in new construction volumes. In the first four months of 2024, the strongest investment demand has been directed at retail and industrial properties.

Read more from the KTI Market Review.

More information:

Hanna Kaleva

hanna.kaleva@kti.fi, p. 040 5555 269

The Finnish Property Market 2024 report has been published

The Finnish Property Market 2024 report has been published.

View the flyer here.

Download The Finnish Property Market full report from here (free of charge).

Orders for printed reports and other matters, please contact us at kti@kti.fi or tel. +358 20 7430 130.

Transaction volume fell to €2.6 billion in 2023

January 16, 2024

According to the KTI statistics, the property transaction volume amounted to €2.6 billion in 2023, which was the lowest volume since 2013. Both in 2021 and 2022, the annual volume exceeded €7 billion. The average size of the transactions was clearly lower compared to previous years, and the number of transactions decreased markedly. In 2023, approximately 180 professional property transactions exceeding one million euro were carried out, while in previous years the number has varied between 250-350 transactions.

In the last quarter of the year, transaction volume amounted to €820 million, which was 38% lower than in the corresponding period in 2022. The highest quarterly volume in 2023 was recorded in April-June, which was the only quarter when the volume exceeded €1 billion. Both in the first and third quarters, the volume remained at only about €400 million.

Residential properties the most traded property sector

Residential properties were the most traded property sector for the third consecutive year, accounting for 27% of the total volume in 2023. However, the volume of residential property transactions only amounted to slightly over €700 million, which was the lowest volume in this sector since 2014. The largest residential portfolio transaction of the year was recorded in late spring, when the US investor KKR acquired 1,200 rental apartments across Finland from Kruunuasunnot. Avant Capital Partners acted as KKR’s investment partner in the transaction.

Both industrial and public use properties accounted for 22% of the total volume. In the industrial property sector, the volume was boosted especially by logistics property transactions. Public use property transaction volume decreased by 65% compared to record-high volume of 2022, but a couple of large public use property portfolios were sold also in 2023. In the last quarter of 2023, eQ Community Properties Fund sold two care property portfolios to Nrep and Northern Horizon’s fund for a total price of approximately €175 million. Also Kinland was active in the transaction market in 2023.

Office and retail property transaction volumes remained low, and they accounted for 17% and 10% of the total volume, respectively. Swedish investor Niam acquired three significant office assets in Finland in 2023 and was the most active player in the office market.

Foreign investors carried out transactions in all property sectors

Foreign investors continued to be active in all property sectors in 2023. In total, foreign investors acquired properties worth over €1.4 bn, while their sales totalled less than €0.5 bn. More than half of foreign investors’ investments were originated from other Nordic countries. KKR was the only newcomer, who entered the Finnish market during the year. Of the domestic property investor groups, property funds were, once again, the most active buyers, accounting for 21% of the total volume. The shares of other domestic investor groups remained low.

More detailed information and analysis on property transactions in Finland can be found in the KTI Transactions information service. For more information, contact: Mikko Soutamo (mikko.soutamo(a)kti.fi, +358 50 548 0480).

KTI Market Review and Rakli-KTI Commercial Property Barometer Autumn 2023: Property transaction volume remains low

The adjustment of the Finnish property market to the rapid increase in interest rates during the past year and a half is still in progress. Property transaction volume remains low, only at €1.8 billion in the first three quarters of 2023. Property yields continue to increase, although real market evidence for yields remains very scarce. Outlook for rental markets remains subdued in office and retail markets, whereas in industrial space markets, rents are expected to continue increasing. In the rental residential markets, the rapid increase in supply in Helsinki metropolitan area in particular has limited rental growth in recent years, but the construction volumes are now decreasing sharply, which is expected to melt down the oversupply.

Read more from the KTI Market Review.